Trader who bet $73.5 billion used multiple fraud techniques, bank says

PARIS -- The French bank Societe Generale said Sunday that a trader who evaded all its controls to bet $73.5 billion -- more than the French bank's market worth -- on European markets hacked computers and "combined several fraudulent methods" to cover his tracks, causing billions in losses...

PARIS -- The French bank Societe Generale said Sunday that a trader who evaded all its controls to bet $73.5 billion -- more than the French bank's market worth -- on European markets hacked computers and "combined several fraudulent methods" to cover his tracks, causing billions in losses.

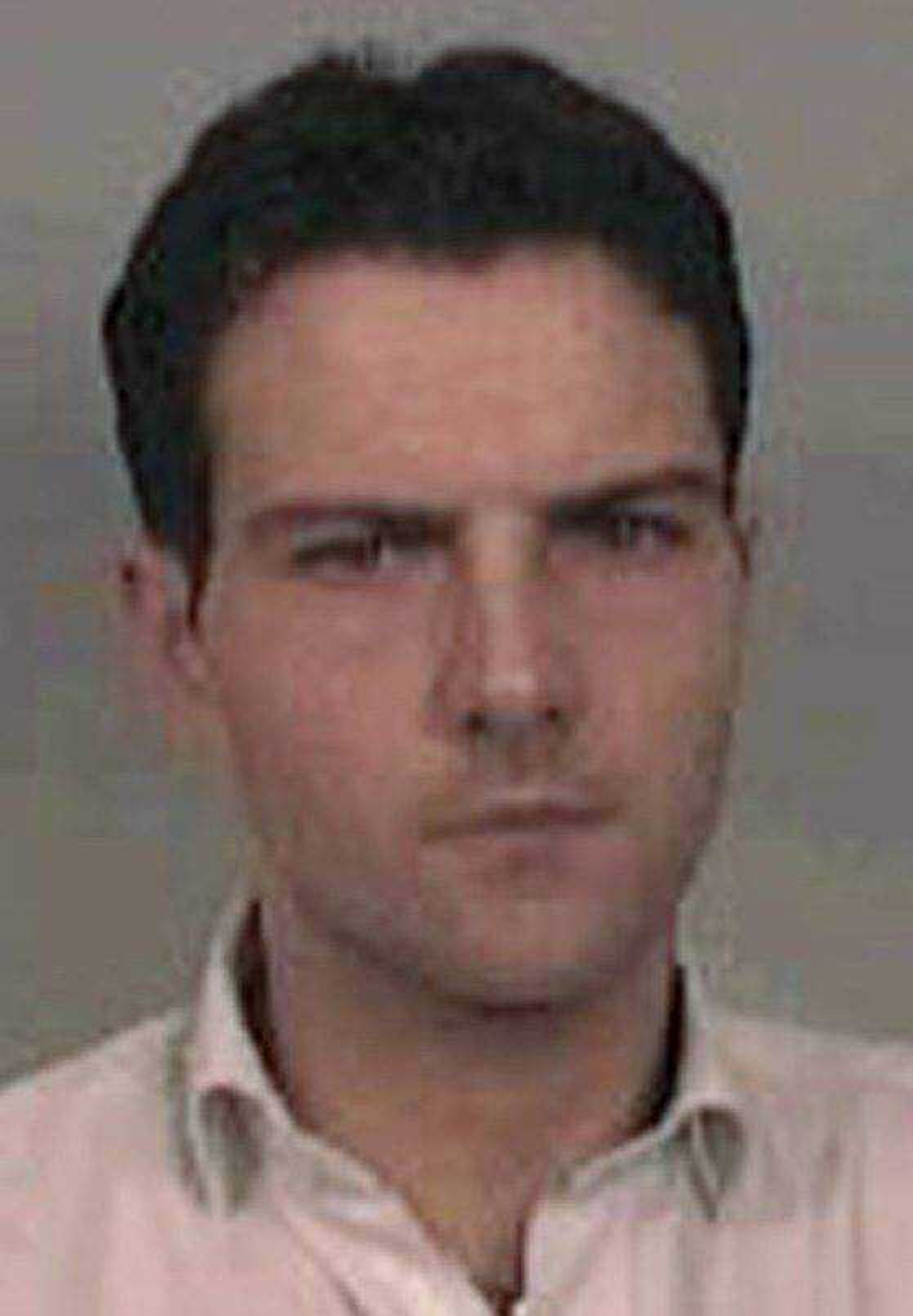

The bank says the trader, Jerome Kerviel, did not appear to have profited personally from the transactions and seemingly worked alone -- a version reiterated Sunday by Jean-Pierre Mustier, chief executive of the bank's corporate and investment banking arm.

But, in a conference call with reporters, Mustier added: "I cannot guarantee to you 100 percent that there was no complicity."

Kerviel's attorney said the accusations of wrongdoing against his client were being used to hide bad investments by the bank related to subprime mortgages in the United States.

"He didn't steal anything, take anything, he didn't take any profit for himself," the lawyer, Christian Charriere-Bournazel, said. "The suspicion on Kerviel allows the considerable losses that the bank made on subprimes to be hidden."

Officials said Kerviel was cooperating with police, who held him for a second day of questioning Sunday, seeking answers to what, if confirmed, would be the biggest-ever trading fraud by a single person.

Kerviel, 31, has not been seen in public since the bank's bombshell revelation Thursday that his unauthorized trades resulted in 4.9 billion euros, or $7.1 billion, in losses.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.