Cape, Scott City gear up for internet sales tax campaigns

Retired banker Danny Essner, long active in community organizations such as Old Town Cape, is taking on a new short-term challenge. Essner will gather this week with other like-minded businesspeople to game out a marketing strategy aimed at persuading Cape Girardeau voters to approve a 2.75% user tax -- a tax on internet sales -- on the Nov. 2 ballot...

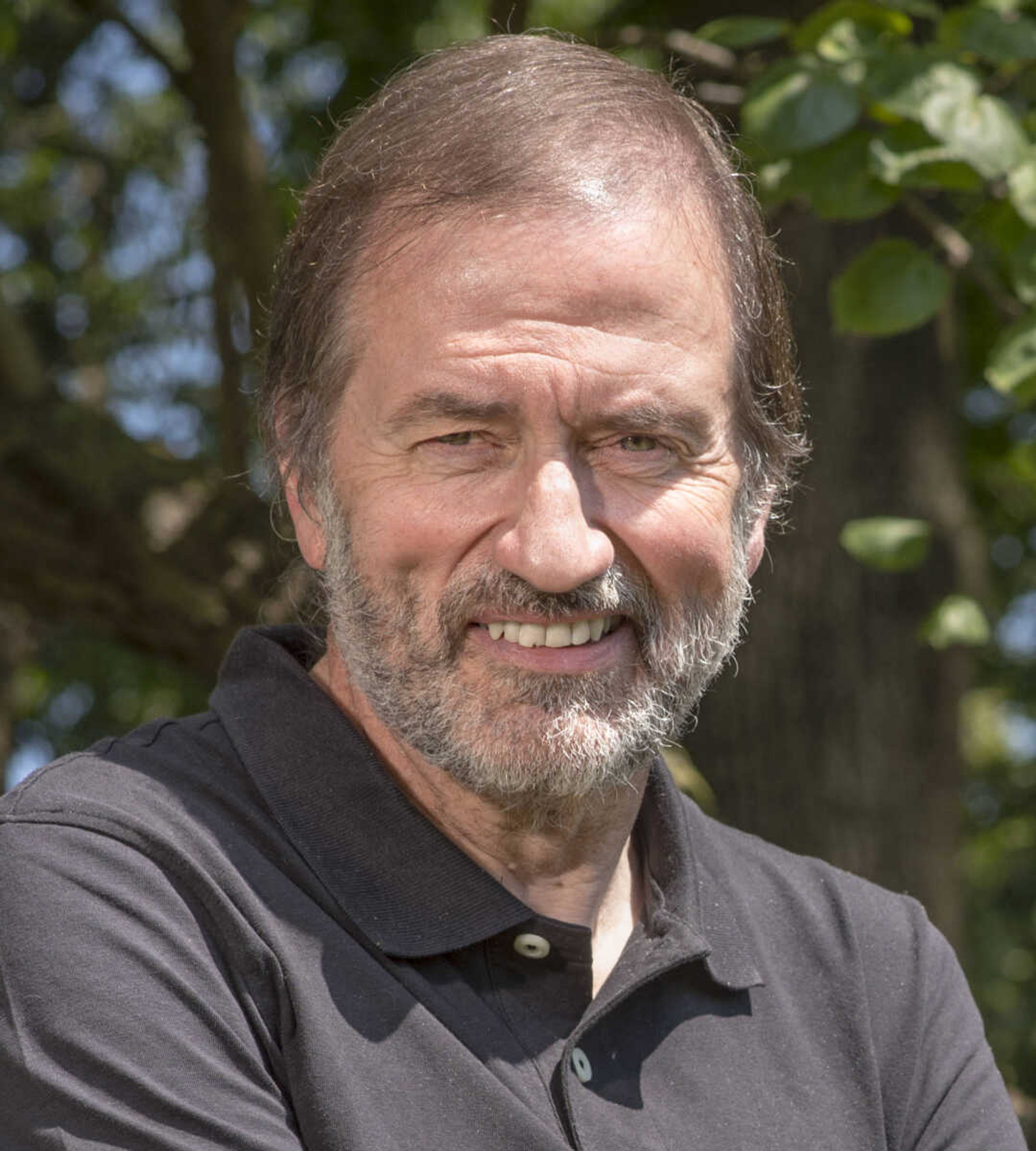

Retired banker Danny Essner, long active in community organizations such as Old Town Cape, is taking on a new short-term challenge.

Essner will gather this week with other like-minded businesspeople to game out a marketing strategy aimed at persuading Cape Girardeau voters to approve a 2.75% user tax -- a tax on internet sales -- on the Nov. 2 ballot.

"We're still recruiting people to serve," said Essner, 71, who adds he thinks "five to 10" private citizens will end up on an ad hoc steering committee attempting to get the levy approved.

Noting specific plans have not yet been made, Essner said Thursday he imagines the campaign may use at least some of the blueprint of the successful drive to pass the original Transportation Trust Fund (TTF) tax, which won 67.8% of the vote in August 1995.

"We may use direct mail, yard signs, social media, for example, because we have to make a compelling case to convince people to vote yes," said Essner, who retired as president of Capaha Bank in June 2017.

"No city funds will be used, and we'll be seeking [private] donations to fund this effort."

Cape Girardeau City Council has announced its collective support for a tax on online sales, but the municipality is not permitted to participate financially in a campaign, according to Mayor Bob Fox.

"Per our charter, our city cannot expend public funds to promote any issue and because of that, businesses and private individuals will be making any contributions necessary," said Fox.

Fox said city staff, council members and supportive individuals will also be engaged in meeting with service clubs and other community organizations to push the initiative.

History

Cape Girardeau voters have turned down a use tax four times in the past quarter-century: 2016, 2014, 2003 and 1996.

Cape Girardeau city manager Ken Haskin told the city's Parks and Recreation Advisory Board Monday, "one of the things that struck me when I arrived here is that the tax is not already in place."

"We're frankly on the tail end of this at the moment," said Essner, who added increased convenience on internet consumer purchases has created an uneven "playing field" for brick-and-mortar businesses who have invested in Cape and in other communities.

"When was the last time an internet retailer out of Seattle sponsored a kids' soccer team in Cape Girardeau?" he asked rhetorically.

Fox said last month the city has estimated approval of the use tax will generate $2.5 to $3 million in annual revenue.

Fox, Haskin, Police chief Wes Blair, Fire chief Randy Morris Jr. and Public Works director Stan Polivick have all gone on record saying use tax revenue will help the city, among other things, improve employee retention efforts.

Scott City

Mayor Norman Brant said Scott City Council, in its regularly scheduled meeting Monday, will likely decide on a marketing strategy aimed at passage of an online sales measure in November.

City Manager Mike Dudek said a use tax should generate more than $200,000 for the municipality.

Scott City Chamber of Commerce president Blake Lingle said chamber members are currently voting via email on whether to support a levy and how anticipated proceeds should be spent.

Brant told an August meeting of the Scott City Chamber of Commerce he would like to apply use tax proceeds for repair of city streets.

"I think we ought to keep our message simple," said Brant Thursday, who advocates use of a letter to city residents to promote approval.

On June 30, Gov. Mike Parson signed the Wayfair bill passed by the Missouri General Assembly, making the Show Me State the last one in the country to approve such enabling legislation for the taxing of internet sales.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.