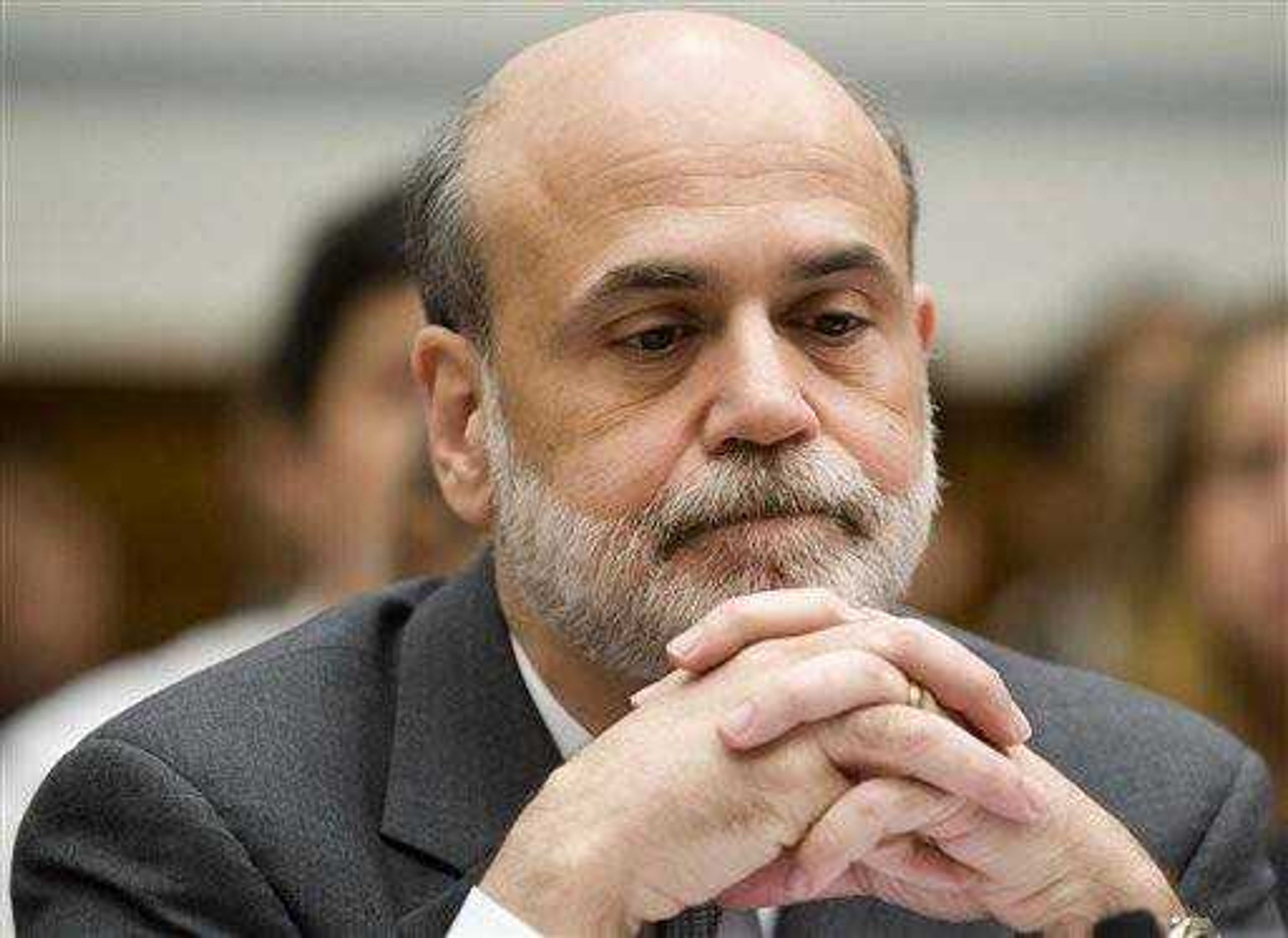

Bernanke preps for hot seat on bailouts, recovery

WASHINGTON -- Federal Reserve Chairman Ben Bernanke likely will face tough questions this week from lawmakers about taxpayer bailouts of financial companies, slow-moving government efforts to curb home foreclosures and the possibility that the Fed's unprecedented steps to stimulate the economy could spur inflation later on...

WASHINGTON -- Federal Reserve Chairman Ben Bernanke likely will face tough questions this week from lawmakers about taxpayer bailouts of financial companies, slow-moving government efforts to curb home foreclosures and the possibility that the Fed's unprecedented steps to stimulate the economy could spur inflation later on.

The Fed chief is scheduled to deliver a fresh report on the country's economic and financial health in back-to-back sessions on Capitol Hill starting Tuesday morning at 10 a.m. EDT with the House Financial Services Committee.

Skeptical lawmakers also are expected to voice concern about an Obama administration proposal that would expand the Fed's oversight duties over big, globally interconnected financial companies whose failure could imperil the national economy.

Bernanke on Tuesday likely will repeat the central bank's belief that the economy will start growing again sometime in the second half of this year helped by record low interest rates and President Barack Obama's $787 billion stimulus package of tax cuts and increased government spending.

Consumer spending appears to have stabilized, new-home sales are flattening out and declines in capital spending do not look as severe as they had at the beginning of the year, the Fed said last week.

"Bernanke's message: guardedly optimistic. We are seeing signs of the economy's impending turnaround. But it is all pretty much impending still," said Bill Cheney, chief economist at John Hancock Financial Services.

Steering the economy from recession to recovery will be a delicate move for Bernanke -- both economically and politically.

The economy sank at an average annual rate of 5.9 percent in the fourth quarter of last year and the first quarter of this year, the weakest performance in 50 years.

Many analysts believe the economy didn't shrink nearly as much in the April-June quarter. (The government releases results for the second quarter at the end of July.) Many believe the economy could start growing again as early as the current quarter, although the pace of the recovery is likely to be plodding, the Fed said last week.

Because of that, the nation's unemployment rate -- now at a 26-year high of 9.5 percent -- will keep climbing. Companies won't be in any mood to ramp up hiring until they feel secure that the recovery has staying power.

By the Fed's own forecasts, the jobless rate could rise as high as 10.1 percent this year. Some Fed officials think it could hit 10.5 percent this year, and 10.6 percent in 2010. The post-World War II high was 10.8 percent at the end of 1982, when the country had suffered through a severe recession.

Rising unemployment is making it harder for people to pay their monthly mortgage bills.

The number of U.S. households on the verge of losing their homes soared by nearly 15 percent in the first half of the year, according to RealtyTrac Inc. Experts expect foreclosures will peak in the middle of next year before heading downward.

Housing, credit and financial debacles created a perfect storm for the economy at levels not seen since the Great Depression. Those negative forces plunged the economy into the longest recession since World War II.

Although credit and financial conditions have improved since last fall, markets are not back to normal. Getting banks to lend more freely again is an important ingredient to turning the economy around.

Recoveries after financial crises tend to be slow. And given the economy's fragile state, it can be vulnerable to any shocks. Against that backdrop, many economists predict the Fed will hold its key bank lending rate at a record low near zero for the rest of this year, with the hope of bracing economic activity.

Expectations for a lethargic recovery should keep a lid on inflation, the Fed has said. With consumers likely to stay cautious amid rising unemployment, companies won't be in a position to jack up prices.

Still, Bernanke will attempt to assure Wall Street investors that the Fed won't let inflation get out of control and that it stands ready to unwind its stimulus when the recovery is more firmly rooted.

Politically, that will be a delicate move because the Fed -- to prevent inflation from taking hold -- is likely to have to start raising rates and dismantling some of its programs when unemployment is still elevated.

Bernanke's term expires early next year, and Obama will have to decide whether to reappoint him or select a new chairman. The Fed chief's innovative policies have been credited with pulling the economy from the edge of the abyss last year. But those actions also have touched off criticism about putting taxpayers at risk and whether the government should be cleaning up Wall Street's messes.

On Wednesday, Bernanke is slated to testify on the economy before the Senate Banking Committee.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.