These retailers could use Christmas cheer

The holiday shopping season is always a make-or-break period for struggling retailers. But this year, the fight to grab shoppers has intensified, making it difficult for stores to use the season that accounts for about 20 percent of the retail industry's annual sales to bounce back...

The holiday shopping season is always a make-or-break period for struggling retailers.

But this year, the fight to grab shoppers has intensified, making it difficult for stores to use the season that accounts for about 20 percent of the retail industry's annual sales to bounce back.

Stores face cautious shoppers who are juggling stagnant wages and higher costs for food and health care. And Web-savvy customers are using information easily available on smartphones to hold out for better deals. All of that means stores have had to discount more -- and earlier -- in the holiday shopping season.

"If you're a retailer on the edge, it's harder to maintain your viability and return to profitability because of the intense promotional environment," said Ken Perkins, president of RetailMetrics LLC, a retail research firm.

He expects fourth-quarter earnings for the 123 retailers he tracks will rise 7.7 percent, down from a projected 16 percent increase in June.

Here, four retailers with years of sales declines that could use a good holiday season:

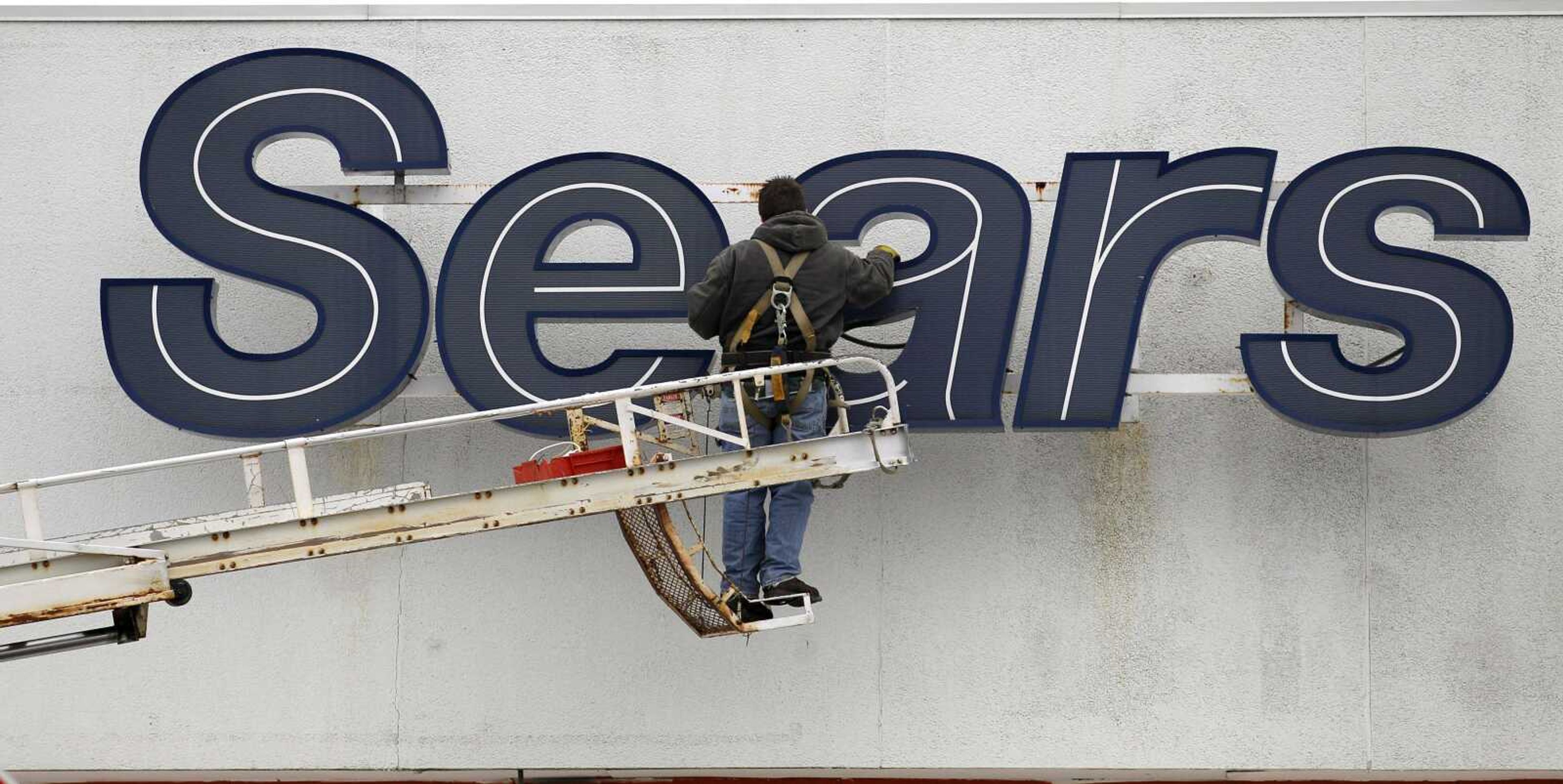

Sears

The problems: The Hoffman, Illinois-based company, which operates Kmart and Sears, has been struggling for years as it faces stiff competition from Wal-Mart, Target and Home Depot. Critics say Sears has failed to update shabby and tired stores.

Billionaire hedge fund manager Edward Lampert, now chairman and CEO, combined Sears and Kmart in 2005, about two years after he helped bring Kmart out of bankruptcy. But that merger hasn't been successful, and the company's financial results keep worsening.

The company Thursday said its revenue fell 13 percent in the third quarter. In the first three-quarters of the year, Sears has lost $1.6 billion.

It's on track to lose money for four straight years and record eight straight years of falling revenue when it reports its annual results early next year.

The fix: To raise money, Lampert is closing weak stores, cutting inventory and selling assets to raise cash to keep the company afloat. At the same time, Sears says it is shifting its focus from running a store network to operating an online and offline business tied together by its Shop Your Way loyalty program.

The prospects: Brian Sozzi, CEO and chief equities strategist at Belus Capital Advisors, says crowds at both chains were thin over the Thanksgiving weekend. And the latest third-quarter results will likely make it critical for Sears to keep selling assets and stores to prop up its operations.

Sozzi believes by 2017, the company will operate about 900 stores, half its current size.

The financial maneuvers "are basically enabling [Sears] to tread water on the operating losses," Everscore ISI's Greg Melich said.

RadioShack

The problems: Long known as a destination for batteries and obscure electronic parts, RadioShack's problem has been that the functions of so many products it sold have been taken up by smartphones.

So it sought to remake itself as a specialist in wireless devices and accessories. But growth in that business is slowing because more people have smartphones and see fewer reasons to upgrade.

RadioShack's shares are trading below $1. It warned in September it might need to file for Chapter 11 bankruptcy, which wasn't unexpected. It bought some more time soon after by restructuring part of its debt with lenders.

The fix: RadioShack's turnaround efforts have included cutting costs, renovating and closing stores, and shuffling management. The Fort Worth, Texas-based company has tried to update its image and work on adding products, including private brands and exclusive items.

The prospects: RadioShack has been fighting with its lenders during the holidays, which is hampering its efforts to restructure the business and close some of its stores to help raise cash. The lenders notified RadioShack of alleged breaches last week to a $250 million loan and wants the company to prepay some of its debt, along with other fees. RadioShack says that is unreasonable.

"I think they're going to close, but it's about doing it on an orderly basis," said David Tawil, co-founder and portfolio manager of Maglan Capital, which follows distressed companies.

Aeropostale

The problems: Teen retailer Aeropostale a widening loss and falling sales Thursday, and its forecast for the holiday quarter mostly fell short of analysts' predictions.

Aeropostale, like many traditional teen destinations including Abercrombie & Fitch and American Eagle Outfitters, has struggled with changing fashion tastes among teens. Those chains face intense competition from fast-fashion retailers like Forever 21 and H&M, which offer a wide and quickly changing array of clothing at low prices.

Aeropostale thrived during the depths of the recession because of its affordable logoed T-shirts and pants. But fashions with brand logos have lost their appeal, and the trendier items that have replaced them have not excited shoppers.

The fix: In August, Aeropostale reinstated its former CEO Julian Geiger. But Geiger told investors this week the chain went too far to try to be trendy in its quest to rival fast fashion chains. "I still believe that while [teens] strive for individuality ... there's still a uniform that they wear that makes them cool and fit in," she said.

The prospects: Aeropostale's "path to reclaiming relevance among teens continues to be an uphill battle," said Randal J. Konik, a Jefferies analyst.

J.C. Penney

The problems: J.C. Penney is trying to recover from a botched transformation plan led by former CEO Ron Johnson that sent its sales in a free fall and resulted in mounting losses.

Mike Ullman returned to the CEO job in April 2013 and has stabilized the business by restoring discounts and basic merchandise. But it's up to Marvin Ellison, who will take over Ullman's job in August, to remake it as a shopping destination.

The fix: In October, Ullman laid out a strategy to improve productivity, expand e-commerce and spruce up departments it said would boost sales to $14.5 billion by fiscal 2017. That's still well below the $17.23 billion it generated before the sales plunge.

The prospects: Analysts are watching how Penney fares this holiday season after growth has slowed in an important sales measurement. A slow holiday season would make investors less confident in their business.

"It calls into question their turnaround strategy and whether it's gaining traction or not," Perkins said.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.