GasBuddy's De Haan talks 'fast and furious' Midwest gas hikes

The cost of motor fuel has jumped across the United States this summer to an average U.S. price north of $3.80 per gallon, with corresponding increases in Missouri and locally. Auto club federation AAA notes the steepest increases have been in the Midwest...

The cost of motor fuel has jumped across the United States this summer to an average U.S. price north of $3.80 per gallon, with corresponding increases in Missouri and locally.

Auto club federation AAA notes the steepest increases have been in the Midwest.

Missouri's average gas price Saturday, Aug, 12, was $3.61 a gallon, 38 cents higher than a month ago and 5 cents higher than a year ago.

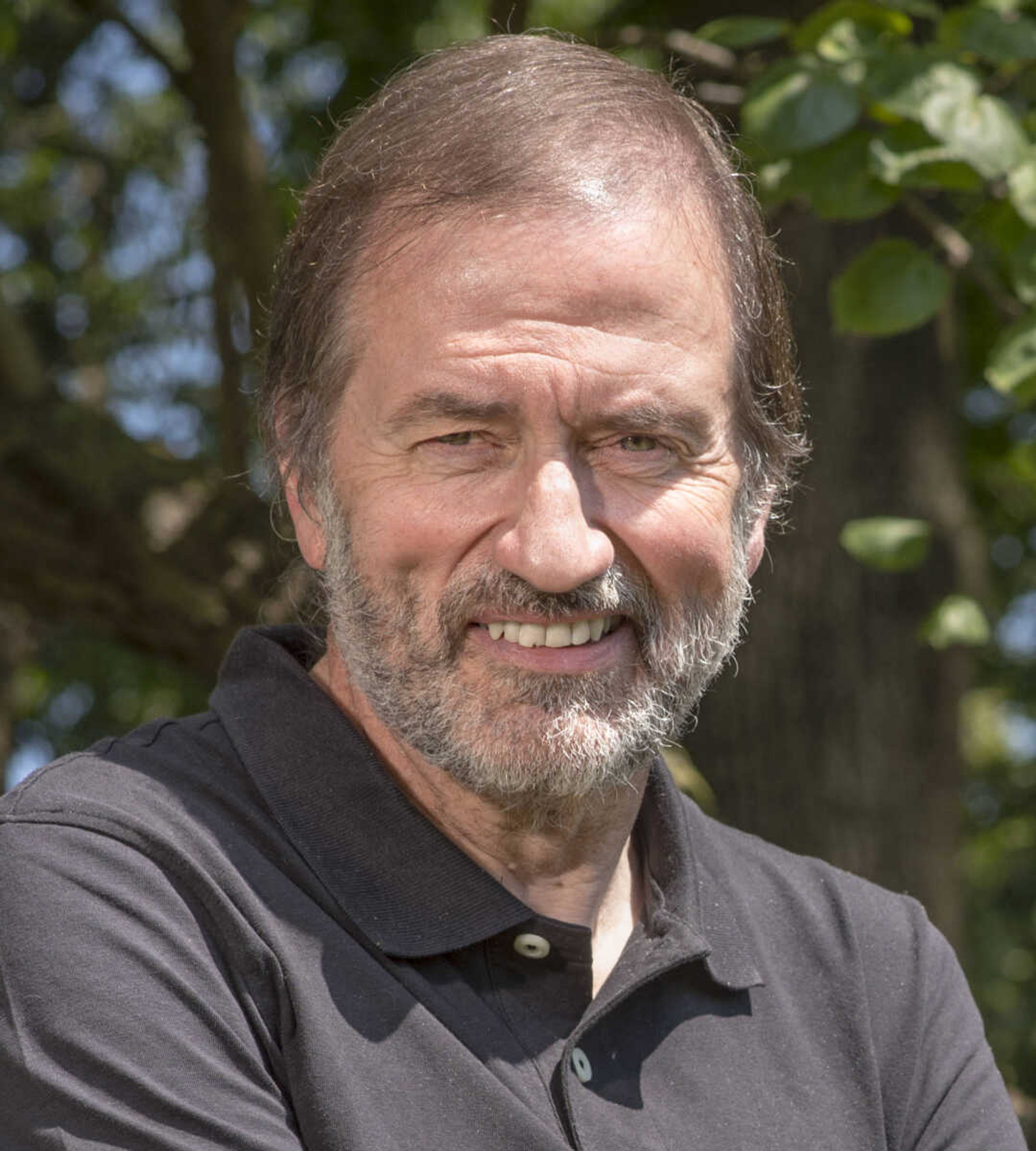

GasBuddy's chief petroleum analyst Patrick De Haan sat down with the Southeast Missourian to answer a few questions about what is causing prices to spike.

What might be said about gas prices that now seem to be close to the level seen in summer 2022?

The increases have been fast and furious. Certainly some of the reason has been due to unexpected refinery failures in Texas and Louisiana caused by extreme heat. We've also seen oil prices rising for six consecutive weeks. Where U.S. prices were the lowest, in states like Missouri, service stations have to react the quickest to these jolts. Higher price states have more room to maneuver when refineries go down or oil shoots up. Diesel, by the way, is on a tear. Depending where someone lives in the country, diesel has risen about $1 a gallon in three weeks. Some stations had seen the heavier weight fuel going under $3 a gallon but now it's closer to $4.

Why does extreme heat cause refineries to fail?

Above 95 degrees, you have to deal with thermal expansion and consequently a facility has to expend a lot more energy to cool down a unit as equipment overheats. Any motorist will recall vehicles breaking down on the highway because they wouldn't cool properly. Same thing with refineries. Remember, a lot of these refineries are 70 to 80 years old. Typically, they're not efficient, brand new facilities. Old facilities, old infrastructure under high temperatures can cause a multitude of problems such as equipment breakdown or thermal expansion. Triple digit temperatures seen in Texas, where some refineries supplying U.S. gas stations are located, can cause reduced capacity, which will rapidly impact price. It's all connected.

You've mentioned in previous interviews the age of American oil refineries. Is it still the case that the move by U.S. carmakers toward electric vehicles has dampened the enthusiasm to build new refinery capacity?

Refining has been historically very much a boom-bust cycle. If the refinery business was as profitable as Apple, you'd see refineries popping up everywhere. There isn't much incentive to build new because of the uncertainty over government regulation. Now, of course, comes EVs and the threat they pose to the oil business. Back in 2020 at the height of COVID, when Americans abruptly and overnight stopped driving, some U.S. refinery capacity just disappeared and it isn't coming back. We've seen a paradigm shift in the refinery landscape because some capacity permanently went offline. Some of it came back, yes, but we're still not where we were pre-COVID. We remain a million barrels a day lower in terms of capacity compared to pre-pandemic days.

Russia and Saudi Arabia say they are cutting production. Discuss that development, please.

This is a major factor. Oil prices have gone up for six straight weeks. You can't really overstate how critical the impact's been on the cut in production from these two countries. It's looking as if the U.S. will need more oil than anticipated since our economy seems to be in a better place than some analysts anticipated. If more oil is needed and with two top world suppliers cutting back, this development could tip the market into a significant imbalance in the months ahead if production fails to keep pace with a stronger global economy.

I've seen reports projecting crude oil continuing to rise to $85 to $90 a barrel. Is this, in your expert opinion, likely?

Sure it is. It's definitely a possibility. If the American economy proves stronger than analysts project, to echo what I said earlier, the U.S. will need more oil, and if things go as I suspect, oil prices may go up more dramatically, especially next year if the Federal Reserve starts to lower interest rates. Consumers may respond by spending more, the economy will continue to improve, and if oil isn't there in sufficient supply, then we could see crude at $90 to $100 a barrel again.

The highest average price I've seen for the U.S. was $4.62 a gallon in June 2022. Are we headed back there given what you've just articulated?

No, I don't see that right now. A lot went wrong to bring us to that price a summer ago. Russia's war with Ukraine pushed oil higher. A steep drop in refining capacity in 2022 did, as well. But we might get close to those prices again if Russia, in particular, continues to tighten its production output. But you know, OPEC holds the whip hand, and if the oil exporting countries wanted to exert some pressure, next year's presidential election might be perfect timing.

What would you say to a Cape Girardeau County motorist who is passing the marquee at his or her favorite service station and sees the price just jumped overnight?

I'd say oil is a global market and lots of factors influence what they see up on that sign. The simple answer is to blame politicians, but when a consumer keeps filling the gas tank regardless of price, that's a message to the global economy that there's an imbalance brewing. Our need for oil is unabated and OPEC, which controls a third of the world's oil supply, knows this. OPEC knows we'll have to dig deeper and that we will.

Do you want more business news? Check out B Magazine, and the B Magazine email newsletter. Go to www.semissourian.com/newsletters to find out more.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.