Understanding Trump's individual income tax plan

President-elect Donald Trump's tax proposal, found at donaldjtrump.com, will simplify the tax code by reducing the number of tax brackets from seven to three and lowering the top marginal tax rate to 33 percent, down from 39.6 percent. In addition, under Trump's plan personal exemptions ($4,000 as of 2015) would be eliminated, but the standard deduction would increase from $6,300 to $15,000 for single filers and from $12,600 to $30,000 for married couples. ...

President-elect Donald Trump's tax proposal, found at donaldjtrump.com, will simplify the tax code by reducing the number of tax brackets from seven to three and lowering the top marginal tax rate to 33 percent, down from 39.6 percent. In addition, under Trump's plan personal exemptions ($4,000 as of 2015) would be eliminated, but the standard deduction would increase from $6,300 to $15,000 for single filers and from $12,600 to $30,000 for married couples. Head-of-household filing status would be eliminated.

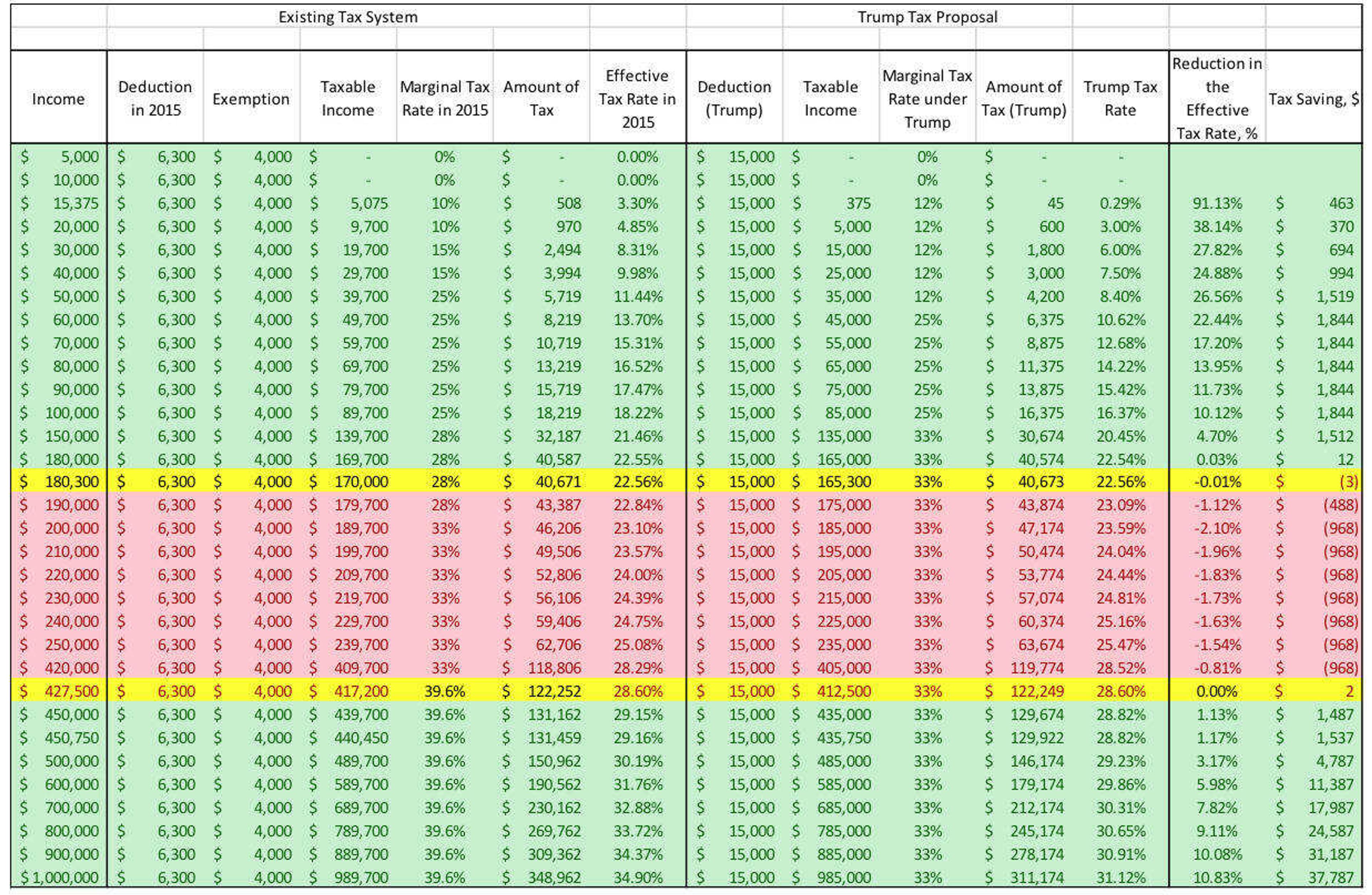

We calculated the amount of tax paid at different levels of income using current and proposed deductions and exemptions to take a closer look at the differences in effective tax rates under the two tax systems for individuals earning up to $1 million.

The effective tax rate, the dollar amount of tax as a proportion of one's income, is a much better representation of the tax rate one pays than is the marginal tax rate (the tax bracket that applies to the last dollar of income earned).

Our calculations reveal that for individuals earning $180,000 or less, the effective tax rate will be lower under the Trump proposal relative to the current tax system. To illustrate, someone who earns exactly $30,000 in 2015, had a taxable income equal to [$30,000 - $6,300 (Standard deduction) - $4,000 (personal exemption)] = $17,700. The amount of tax they paid in 2015 would be $9,225 x 10 percent + $10,475 x 15 percent = $2,493.75, which is effectively 8.31 percent of the total income earned. Under Trump's proposal, the new taxable income would be $15,000 ($30,000 minus the standard deduction) that would place an individual in the 12 percent tax bracket and they would be responsible for a tax payment of $1,800 or effectively 6 percent of $30,000. To summarize, for a worker earning $30,000 a year, the effective tax would be 27.81 percent lower than the current effective tax rate, which will translate into a saving of $693.75. These benefits continue to accrue for individuals earning less than $180,000.

The group of income earners between $180,300 and $427,500 will pay a slightly higher effective tax rate, but the differences are rather small: an increase in the effective tax rate of at most 2 percent (or up to $968) relative to 2015 tax rate. The group of tax payers earning incomes greater than $427,000 will also see their effective tax rate decrease relative to the current tax rate. Assuming the standard deduction, the reduction in relative effective tax rate is calculated to be as large as 10.82 percent, which translates into a saving of up to or $37,878. Insofar as this group is likely to itemize deductions vs. taking the standard deduction, the tax savings presented in the table are underestimated.

While Mr. Trump's website states that his proposal aims to "reduce taxes across-the-board, especially for working and middle-income Americans who will receive a massive tax reduction," it appears that the tax cut is not uniform across different categories of tax payers: the plan benefits those making less than $180,000, marginally makes worse off those making $180,300-$427,500 and offers humongous tax cuts of those making more than $427,500.

To summarize, the effective tax is not reduced across the board, with the group making between $180,000 and $427,500 at a slight disadvantage, and the rich getting the most benefit of the tax cut.

Dr. Natallia Gray, Ph.D. is an Assistant Professor of Economics at Southeast Missouri State University.

Mr. Brett Kazandjian is a graduate student of Business Administration with Financial Management emphasis at Southeast Missouri State University.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.