Tax Credits for Child Advocacy Centers

Thanks to the support of the Missouri legislators and Gov. Nixon, the Children in Crisis Tax Credits have been reinstated. The tax credits allow donations to approved organization such as Beacon Health Center's child advocacy center, to qualify for 50% state tax credits...

Thanks to the support of the Missouri legislators and Gov. Nixon, the Children in Crisis Tax Credits have been reinstated. The tax credits allow donations to approved organization such as Beacon Health Center's child advocacy center, to qualify for 50% state tax credits.

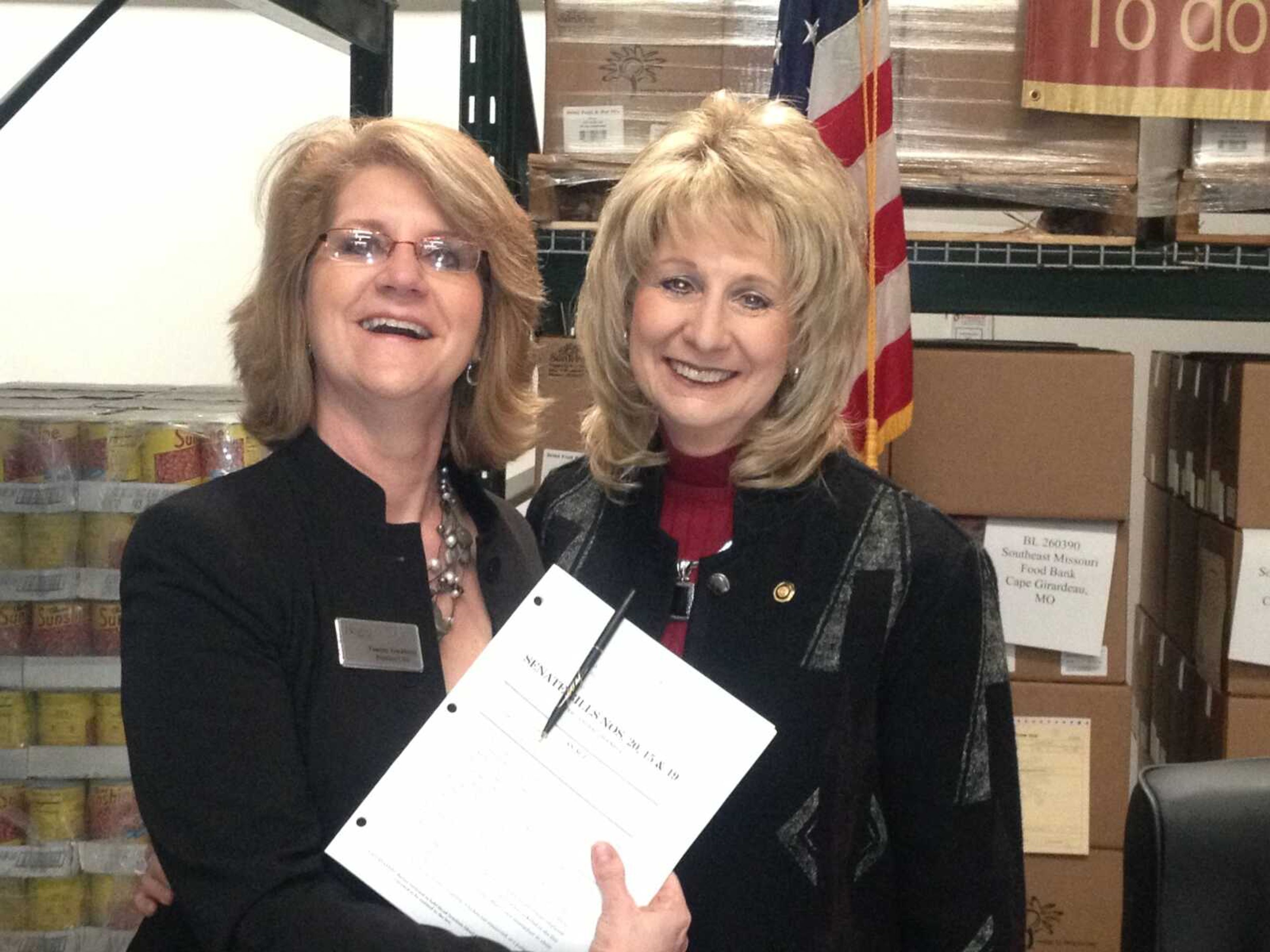

According to Tammy Gwaltney, Beacon Health Center's President/CEO, the tax credits allow citizens to direct where their taxes will go. No one likes to pay taxes but by using tax credits, taxpayers have a voice in how those dollars will be spent.

As part of the legislation, donations received by organizations such as Beacon as of January 1, 2013 that are qualified donations are eligible for the credit. Also donations made from now until the end of the calendar year may also qualify. The minimum donation for the tax credit is $50.

Anyone wanting more information regarding this credit can contact Tammy at 332-1900.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.