The IRS tightens the screws on the gig economy

The IRS is so kind. Our most beloved federal agency has delayed until next year a new income-reporting law it has carefully designed to squeeze the last drops of tax revenue out of many of us. The new IRS rule is aimed at millions of self-employed people and small-business people who sell goods or services on places such as eBay, drive part-time for Uber or earn income through social media companies such as Airbnb...

The IRS is so kind.

Our most beloved federal agency has delayed until next year a new income-reporting law it has carefully designed to squeeze the last drops of tax revenue out of many of us.

The new IRS rule is aimed at millions of self-employed people and small-business people who sell goods or services on places such as eBay, drive part-time for Uber or earn income through social media companies such as Airbnb.

Right now, the requirement for having to report this kind of side-hustle income to the taxman are transactions where payments exceed $20,000, or more than 200 transactions per year.

But starting in the 2024 tax year, the IRS will tighten the screws on the little guys that make the gig economy go.

Anyone who makes $600 or more selling an old roll-top desk on eBay or working as a freelance writer for a blog site will be required to report their income to the IRS.

The companies they use to sell their stuff online, such as PoshMark, or that they work for, such as Uber, also will be required to issue them a 1099-K form and tell the IRS so their income can be taxed.

The new $600 1099-K reporting rule, which also affects all payments over $600 between individuals that are made using third-party payment systems such as Venmo or PayPal, was delayed for a year.

How it became law is a perfect example of how our politicians and the federal government operate.

It was buried nearly 200 pages deep in the Democrats' $1.9 trillion American Rescue Plan Act of 2021, which runs to nearly 250 pages of legalistic bureaucratic mumbo-jumbo.

Anyone who read Section 9674 — and few in Congress ever did — would have no clue that the 1099-K reporting requirement was being cut from what it is now — $20,000 — to $600.

The IRS said they pushed the 1099-K changes back to 2024 because they wanted to give businesses time to prepare for the changes. Yeah, right.

The delay was really a result of the loud stink raised by people who engage in the gig economy, angry taxpayers and especially the lobbyists of the internet companies who would now bear all the costs of record keeping.

Of course, unfair and confusing taxes such as this new 1099-K rule are the meat and potatoes of the IRS and the politicians in Washington who give it its evil and expanding powers.

All year long, all you hear from the Democrat Party and the liberal media is "We've got to tax the rich" or "The rich have to pay their fair share."

But when it comes down to actually writing the tax laws, what do the politicians who've built up our national debt to $32 trillion do?

They usually end up taxing the little fish because there are so many more of them and that's where the most money is.

The new $600 cutoff rule won't touch the rich, of course.

The big fish can always hire accountants and lawyers to avoid a tax. Or they can get their political pals in Congress to slip little loopholes into the tax code that get them off the hook to Uncle Sam.

But the new 1099-K rule will hurt the young, the poor, the small business person, the self-employed and the middle class.

They're the ones who'll lose income. They're the ones who'll have to report the sales of their dad's old shirt on PoshMark — or be turned into criminals.

The IRS claims the $600 rule will generate $8.4 billion in 10 years for federal coffers — a pittance compared to the trillions Washington spends each year.

It's on hold until 2024, for now. It'd be nice if we could count on House Republicans to cancel it this year, but don't count on it.

The way things work in Washington, it won't surprise me if IRS agents start showing up at our garage sales.

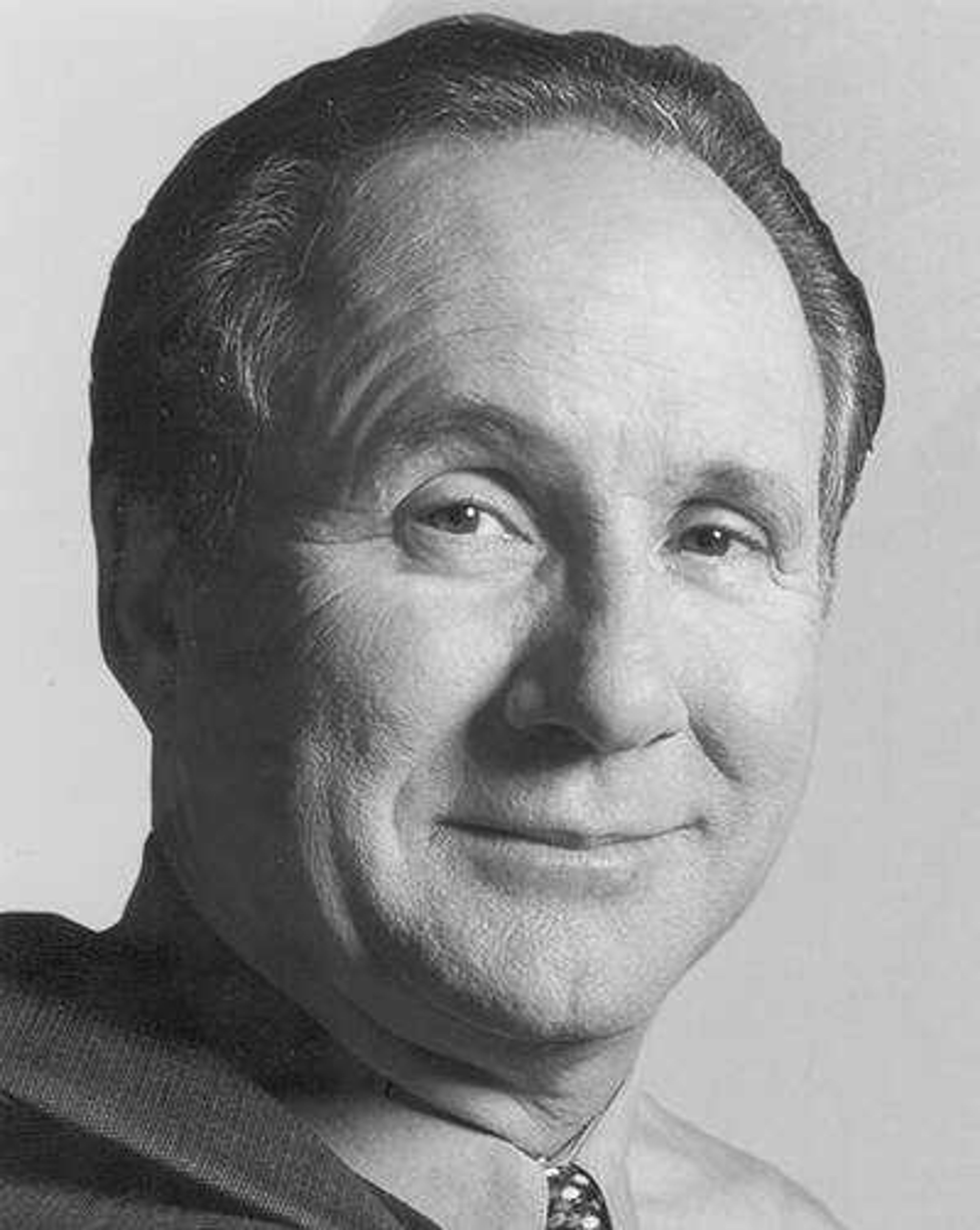

Michael Reagan, the son of President Ronald Reagan, is an author, speaker and president of the Reagan Legacy Foundation.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.