Burger, Francis with wish list for revenue from new state gas tax hike

The first increase in Missouri's fuel tax in 25 years takes effect today, the first of several hikes intended to raise Missouri's 17-cent-a-gallon tax to 29.5 cents per gallon in July 2025 and generate hundreds of millions of dollars in new revenue to fund road and bridge projects...

The first increase in Missouri's fuel tax in 25 years takes effect today, the first of several hikes intended to raise Missouri's 17-cent-a-gallon tax to 29.5 cents per gallon in July 2025 and generate hundreds of millions of dollars in new revenue to fund road and bridge projects.

The increase taking effect now is 2.5 cents per gallon.

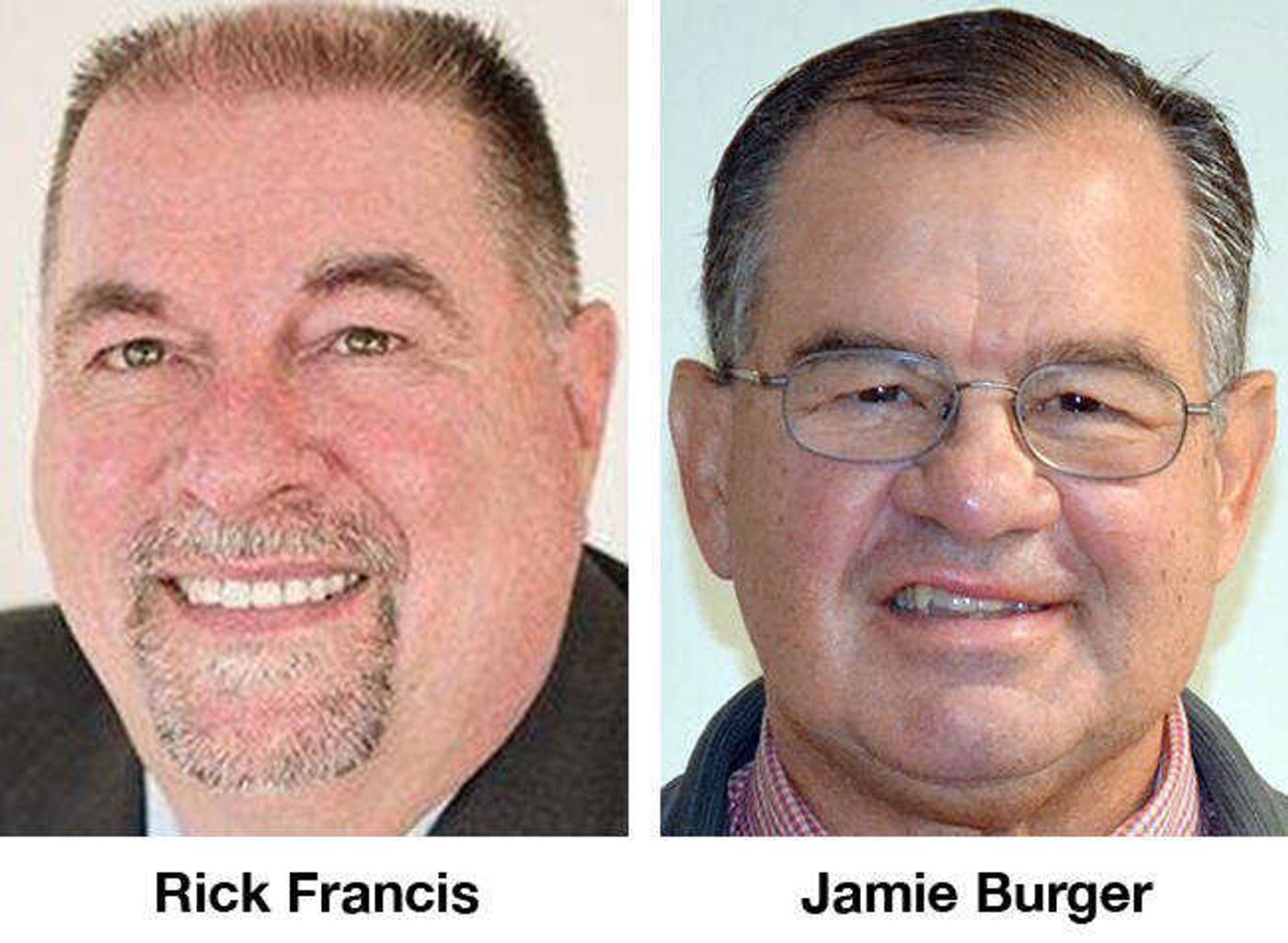

Rep. Rick Francis of Perryville, Missouri, (R-145), who was among 104 lawmakers to approve the graduated increases this spring, told the Southeast Missourian on Thursday his initial wish for the money is to see a new bridge connecting Perryville and Chester, Illinois.

Last month, the Missouri Highways and Transportation Commission approved an amendment to a statewide transportation improvement plan to fund replacing the nearly 80-year-old bridge at an estimated cost of more than $180 million.

The Chester Bridge, first built in 1942 and which carries approximately 7,000 vehicles daily, has 11-foot lanes crossing the Mississippi River without a shoulder. A new span likely would include 12-foot lanes with shoulders on each side.

"For our rural communities, it is imperative we maintain roads and bridges that our parents and grandparents built," Francis said.

Rep. Jamie Burger of Benton, Missouri, (R-148) also voted "yes" on the gas tax hike and wants to see the increased funding go to extending Interstate 57 west toward Dexter, Missouri, and Poplar Bluff, Missouri.

"We've been talking about this for many, many years. Right now, if you're coming on I-57 from Charleston toward Sikeston, when you hit I-55, (the road) turns into Highway 60 west. If 57 can continue past the I-55 exchange, there would be more crossovers and more extension of businesses," Burger said Thursday.

Burger said he also wants to see something done with "lettered" roads.

"Our farm-to-market roads are often also used for school bus routes. General maintenance and upkeep on these roads are critical," he said.

"I was on (Route) JJ in Mississippi County not long ago (and) it's about to return to gravel, it's in such bad shape."

Rebate opportunity

Missourians who keep their gas tax receipts going forward will be able to get a refund. The receipts must be kept for three years.

Once per year, state officials say motorists who purchase gas for vehicles weighing less than 26,000 pounds will be able to submit a refund claim equal to the amount of the hike in the gas tax.

Missouri is modeling its refund system after one currently in effect in South Carolina.

The Missouri Department of Revenue is developing an online form for submittal.

At least 29 states have raised fuel taxes since 2013. Missouri's increase would be the first since Virginia lawmakers passed a gas tax increase in March 2020, shortly before the COVID-19 shutdowns.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.