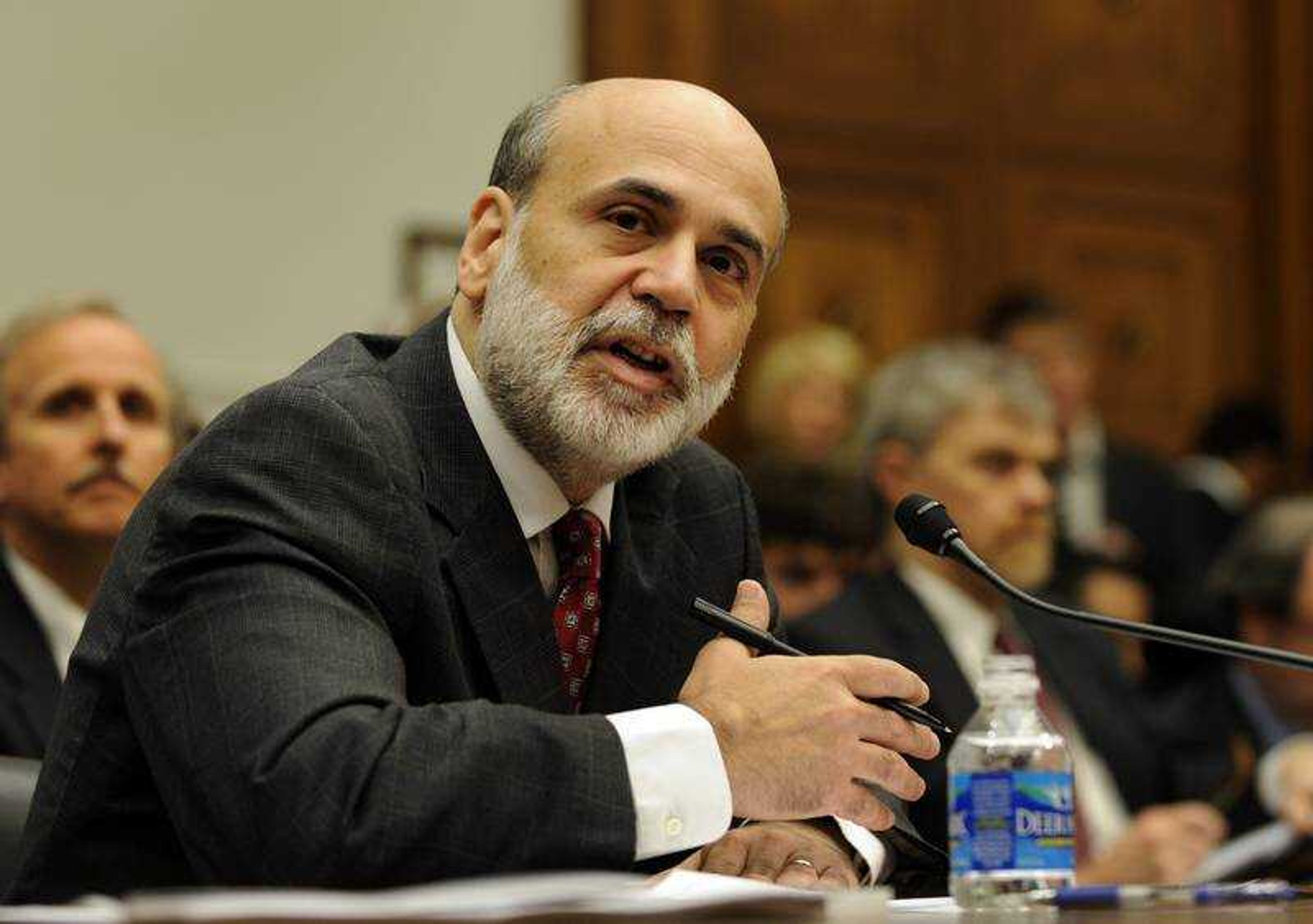

Bernanke tries to settle nerves over economy, banks

WASHINGTON -- In an appearance before House Financial Services Committee on Wednesday, Federal Reserve chairman Ben Bernanke sought to soothe nerves frazzled by rising prices for food and oil, slumping home values and faltering banks. "We will work our way through these financial storms," he said...

WASHINGTON — In an appearance before House Financial Services Committee on Wednesday, Federal Reserve chairman Ben Bernanke sought to soothe nerves frazzled by rising prices for food and oil, slumping home values and faltering banks.

"We will work our way through these financial storms," he said.

Bernanke focused on one of those maelstroms Wednesday, when he said troubled mortgage giants Fannie Mae and Freddie Mac are in "no danger of failing."

Trying to stem eroding investor confidence in the two companies, the Treasury Department and the Fed on Sunday offered to throw them a financial lifeline if they needed it to stay afloat. The two companies hold or guarantee more than $5 trillion in mortgages — almost half of the nation's total — and are major sources of financing for the mortgage market.

The Bush administration is asking Congress to temporarily increase lines of credit to Fannie and Freddie and to let the government buy their stock. The Fed has offered to let the companies draw emergency loans. Those pledges of aid have raised concerns on Capitol Hill and elsewhere about the government's role in intervening to ease such financial troubles and the risk posed to taxpayers.

The Fannie and Freddie troubles came on the heels of the failure of IndyMac Bank, which was taken over last Friday by the Federal Deposit Insurance Corporation.

Connect with the Southeast Missourian Newsroom:

For corrections to this story or other insights for the editor, click here. To submit a letter to the editor, click here. To learn about the Southeast Missourian’s AI Policy, click here.